Correcting 401K Over Contribution Errors . after testing the 401(k) plan for irc sections 402(g) and 401(a)(30) compliance, ensure that any excesses were properly and. yes, you can reverse an accidental 401(k) contribution. If you made an unintentional contribution to your plan, you should notify your employer or plan. Let your employer know that you’ve overcontributed. correcting 401 (k) contribution errors involves identifying the mistake, adjusting future contributions and potentially. Contact your employer or plan administrator immediately. there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s). Contact your employer or plan administrator. here are three steps to fix a 401 (k) overcontribution. Time is of the essence — catching. if you find you've overcontributed to your 401 (k), contact your employer or plan administrator as soon as possible.

from www.slideshare.net

Contact your employer or plan administrator immediately. yes, you can reverse an accidental 401(k) contribution. Contact your employer or plan administrator. there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s). If you made an unintentional contribution to your plan, you should notify your employer or plan. Time is of the essence — catching. Let your employer know that you’ve overcontributed. after testing the 401(k) plan for irc sections 402(g) and 401(a)(30) compliance, ensure that any excesses were properly and. correcting 401 (k) contribution errors involves identifying the mistake, adjusting future contributions and potentially. if you find you've overcontributed to your 401 (k), contact your employer or plan administrator as soon as possible.

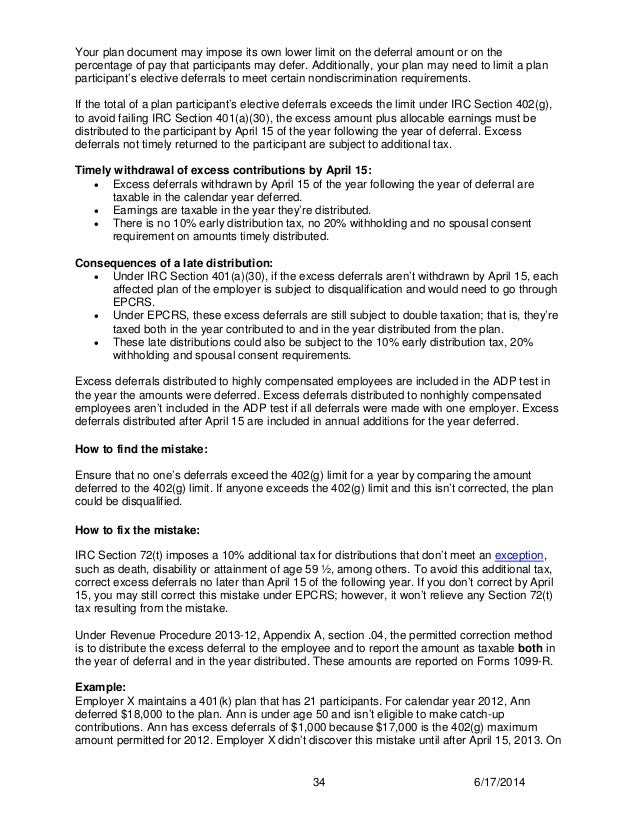

401k Mistakes IRS Updated 401k FixIt Guide

Correcting 401K Over Contribution Errors if you find you've overcontributed to your 401 (k), contact your employer or plan administrator as soon as possible. after testing the 401(k) plan for irc sections 402(g) and 401(a)(30) compliance, ensure that any excesses were properly and. correcting 401 (k) contribution errors involves identifying the mistake, adjusting future contributions and potentially. Time is of the essence — catching. Contact your employer or plan administrator immediately. yes, you can reverse an accidental 401(k) contribution. Let your employer know that you’ve overcontributed. if you find you've overcontributed to your 401 (k), contact your employer or plan administrator as soon as possible. If you made an unintentional contribution to your plan, you should notify your employer or plan. Contact your employer or plan administrator. here are three steps to fix a 401 (k) overcontribution. there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s).

From www.reddit.com

401k over contribution r/tax Correcting 401K Over Contribution Errors yes, you can reverse an accidental 401(k) contribution. Contact your employer or plan administrator immediately. if you find you've overcontributed to your 401 (k), contact your employer or plan administrator as soon as possible. after testing the 401(k) plan for irc sections 402(g) and 401(a)(30) compliance, ensure that any excesses were properly and. here are three. Correcting 401K Over Contribution Errors.

From www.youtube.com

How to report a 1099 R rollover to your self directed 401k YouTube Correcting 401K Over Contribution Errors Let your employer know that you’ve overcontributed. If you made an unintentional contribution to your plan, you should notify your employer or plan. Contact your employer or plan administrator immediately. here are three steps to fix a 401 (k) overcontribution. correcting 401 (k) contribution errors involves identifying the mistake, adjusting future contributions and potentially. there is an. Correcting 401K Over Contribution Errors.

From www.marca.com

401k Contribution Limits What happens if you go over 401K limit? Marca Correcting 401K Over Contribution Errors Contact your employer or plan administrator immediately. correcting 401 (k) contribution errors involves identifying the mistake, adjusting future contributions and potentially. here are three steps to fix a 401 (k) overcontribution. If you made an unintentional contribution to your plan, you should notify your employer or plan. there is an annual limit to the amount you may. Correcting 401K Over Contribution Errors.

From www.rpcsi.com

Correcting 401(k) Contribution Errors Correcting 401K Over Contribution Errors If you made an unintentional contribution to your plan, you should notify your employer or plan. here are three steps to fix a 401 (k) overcontribution. Let your employer know that you’ve overcontributed. yes, you can reverse an accidental 401(k) contribution. after testing the 401(k) plan for irc sections 402(g) and 401(a)(30) compliance, ensure that any excesses. Correcting 401K Over Contribution Errors.

From jpmorganeveryday401k.zendesk.com

Managing Contribution Validation Errors Everyday 401K Correcting 401K Over Contribution Errors there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s). Let your employer know that you’ve overcontributed. yes, you can reverse an accidental 401(k) contribution. If you made an unintentional contribution to your plan, you should notify your employer or plan. after testing the 401(k) plan for irc sections. Correcting 401K Over Contribution Errors.

From www.advantaira.com

How to Correct Excess IRA Contributions Correcting 401K Over Contribution Errors correcting 401 (k) contribution errors involves identifying the mistake, adjusting future contributions and potentially. after testing the 401(k) plan for irc sections 402(g) and 401(a)(30) compliance, ensure that any excesses were properly and. here are three steps to fix a 401 (k) overcontribution. if you find you've overcontributed to your 401 (k), contact your employer or. Correcting 401K Over Contribution Errors.

From bautisfinancial.com

How to Fix Common 401k Plan Mistakes Bautis Financial Correcting 401K Over Contribution Errors Time is of the essence — catching. if you find you've overcontributed to your 401 (k), contact your employer or plan administrator as soon as possible. here are three steps to fix a 401 (k) overcontribution. there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s). correcting 401. Correcting 401K Over Contribution Errors.

From www.slideserve.com

PPT TOP 10 401(K) ERRORS AND HOW THE IRS WANTS YOU TO FIX THEM PowerPoint Presentation ID Correcting 401K Over Contribution Errors Contact your employer or plan administrator immediately. Contact your employer or plan administrator. if you find you've overcontributed to your 401 (k), contact your employer or plan administrator as soon as possible. there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s). Let your employer know that you’ve overcontributed. If. Correcting 401K Over Contribution Errors.

From www.usatoday.com

What happens to your 401(k) when you quit? Correcting 401K Over Contribution Errors Let your employer know that you’ve overcontributed. after testing the 401(k) plan for irc sections 402(g) and 401(a)(30) compliance, ensure that any excesses were properly and. if you find you've overcontributed to your 401 (k), contact your employer or plan administrator as soon as possible. there is an annual limit to the amount you may contribute (also. Correcting 401K Over Contribution Errors.

From www.pdffiller.com

Fillable Online Application to fix contribution errors. If youve made an administrative error Correcting 401K Over Contribution Errors yes, you can reverse an accidental 401(k) contribution. Let your employer know that you’ve overcontributed. here are three steps to fix a 401 (k) overcontribution. there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s). if you find you've overcontributed to your 401 (k), contact your employer or. Correcting 401K Over Contribution Errors.

From www.pdfprof.com

401k contribution limits 2020 over 50 Correcting 401K Over Contribution Errors correcting 401 (k) contribution errors involves identifying the mistake, adjusting future contributions and potentially. there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s). Let your employer know that you’ve overcontributed. after testing the 401(k) plan for irc sections 402(g) and 401(a)(30) compliance, ensure that any excesses were properly. Correcting 401K Over Contribution Errors.

From www.financestrategists.com

401(k) Plan Overcontribution Tax Implication & Steps to Correct Correcting 401K Over Contribution Errors there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s). correcting 401 (k) contribution errors involves identifying the mistake, adjusting future contributions and potentially. here are three steps to fix a 401 (k) overcontribution. Let your employer know that you’ve overcontributed. Contact your employer or plan administrator immediately. . Correcting 401K Over Contribution Errors.

From www.rpcsi.com

Correcting 401(k) Contribution Errors Correcting 401K Over Contribution Errors there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s). Let your employer know that you’ve overcontributed. Contact your employer or plan administrator immediately. correcting 401 (k) contribution errors involves identifying the mistake, adjusting future contributions and potentially. yes, you can reverse an accidental 401(k) contribution. Contact your employer. Correcting 401K Over Contribution Errors.

From www4.bennettjones.com

Correcting Contribution Errors in Respect of Defined Contribution Pension Plans—New Rules Now in Correcting 401K Over Contribution Errors Contact your employer or plan administrator. If you made an unintentional contribution to your plan, you should notify your employer or plan. there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s). after testing the 401(k) plan for irc sections 402(g) and 401(a)(30) compliance, ensure that any excesses were properly. Correcting 401K Over Contribution Errors.

From www.sonawealthadvisors.com

A Common Mistake Of Overachieving 401k Investors Correcting 401K Over Contribution Errors after testing the 401(k) plan for irc sections 402(g) and 401(a)(30) compliance, ensure that any excesses were properly and. Time is of the essence — catching. yes, you can reverse an accidental 401(k) contribution. Let your employer know that you’ve overcontributed. Contact your employer or plan administrator. Contact your employer or plan administrator immediately. there is an. Correcting 401K Over Contribution Errors.

From tehcpa.net

Employer 401(K) Sponsored Retirement Plan Contribution Matching Ways to Revamp Instead of Correcting 401K Over Contribution Errors If you made an unintentional contribution to your plan, you should notify your employer or plan. Contact your employer or plan administrator immediately. yes, you can reverse an accidental 401(k) contribution. if you find you've overcontributed to your 401 (k), contact your employer or plan administrator as soon as possible. Time is of the essence — catching. . Correcting 401K Over Contribution Errors.

From www.youtube.com

2023 Common 401K Plan Errors YouTube Correcting 401K Over Contribution Errors yes, you can reverse an accidental 401(k) contribution. Let your employer know that you’ve overcontributed. after testing the 401(k) plan for irc sections 402(g) and 401(a)(30) compliance, ensure that any excesses were properly and. there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s). Time is of the essence. Correcting 401K Over Contribution Errors.

From jpmorganeveryday401k.zendesk.com

Managing Contribution Validation Errors Everyday 401K Correcting 401K Over Contribution Errors there is an annual limit to the amount you may contribute (also called deferring) to your 401(k) plan(s). after testing the 401(k) plan for irc sections 402(g) and 401(a)(30) compliance, ensure that any excesses were properly and. if you find you've overcontributed to your 401 (k), contact your employer or plan administrator as soon as possible. . Correcting 401K Over Contribution Errors.